Payroll-Services

- Salary Payments

- Job Letters

- NHT Letters

- Tax Compliance Certificate Letters

- Advances on Salary

- Advice to Staff

- Calculation and Preparation of NHT, NIS, PAYE and ED Tax lumpsum payments to the collaborate on a monthly basis.

- Calculation of UAWU overtime - done after the submission of overtime form to the Payroll Section

- Preparation of Cheques Outside of Normal Payroll (e.g. errors on Salary; information entered the PeopleSoft System late)

- Preparation of Pay Package for UAWU Staff members which is then submitted to the Bank for collection.

- Packaging of Cheques and Salary Slips - which are then sent to the porters lodge for distribution

- Payment for Academic Staff - Contracts sent from Appointment or Office of Administration the Salary is confirmed by Payroll, allowances are included and Bank Payment calculated (if necessary)

- Mailing of Pay Slips (e.g. to Western Jamaica SCS - Montego Bay)

- Lodging of Payments to UAWU Staff Members accounts at various Banks

- Returned Salaries: cheques not collected by employee and is returned to the Payroll Section which must be done when requested by the employee.

IMPORTANT INFORMATION

Deductions Taken Before Income Tax: -

Superannuation/FSSU, NIS, and Tax Free Sum Percentage Of Statutory Deduction

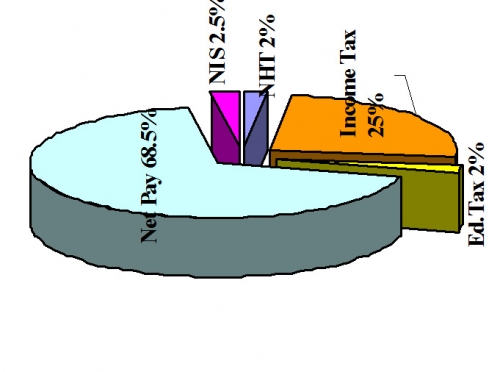

Income Tax …….25 %

NHT…………….……..2%

Ed Tax……………….2%

NIS……………………..2.5% (Up to a maximum Salary of $500,000 p.a.)

Persons Exempted From Income Tax

- Employees who are Physically Challenged

- Register with:- Jamaica Council for Persons With Disabilities; 18 Ripon Road OR Jamaica Council for the Handicapped 92 Hanover Street

- Expatriates Recruited from the United Kingdom & USA

- Must be a resident of the UK or USA (Lived and Work there for 2 years or more)

- Recruited from UK or USA

- Appointed here in a teaching or research profession

(In all cases this must be approved by the Inland Revenue Department)

The Income Tax Threshold

| Year | Amount | Year |

Amount |

| 1986–1988 |

8,580 |

1997-1998 |

80,496 |

| 1989-1991 |

10,400 |

1999–2000 |

100,464 |

| 1992 |

14,352 |

2001–2003 |

120,432 |

| 1993 |

18,408 |

2004 |

120,432 |

| 1994 |

22,464 |

2005 |

132,600(144,768 + 120,432)/2 |

| 1995 |

35,568 |

2006 |

193,440 |

| 1996 |

50,544 |

2007 |

193,440 |

Additional $45,000 p. a. for Retiree (65 years & over)

Additional $45,000 p. a. for Pensioners

Visit the Income Tax website www.jamaicatax.gov.jm.

Additional $45,000 p. a. for Pensioners

Visit the Income Tax website www.jamaicatax.gov.jm.